I Can See Clearly Now: Supplemental Vision Insurance Is Here

Aging is inevitable; after surviving several recessions, Baby Boomers moving into their golden years are now dealing with cataracts, glaucoma, and other vision conditions associated with aging. Since at least 1 in 26 adults over 40 have a visual impairment in the USA, people turn to top vision insurance providers for supplemental vision insurance that complements their Medicare Advantage plan.

If you’re wondering why people prioritize vision insurance, here’s how streamlining protection for your vision can help prepare you for the inevitable changes that occur with age. But first, what causes our vision to change?

How Aging Affects Vision

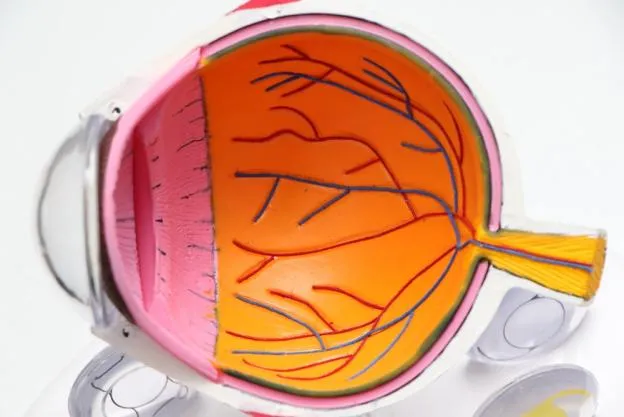

Our eyes can see light when it passes through the pupil and cornea. A lens then focuses it onto a retina, responsible for converting light into a nerve signal that our brain can process. A report published by the American Federation for the Blind about vision loss due to aging revealed that macular degeneration, glaucoma, cataracts, corneal diseases, and diabetic retinopathy are among the most prominent issues that can affect vision. Aging causes this structure to change, which affects our vision in different ways. From color blindness to the narrowed field of vision or weakened eye muscles, aging can lead to several partially treatable conditions.

How Does Supplemental Vision Insurance Help?

While you can sometimes spot the symptoms of vision problems, most signs are undetectable to the naked eye. As you age, you’ll need regular eye exams; if you don’t already have a reliable eye doctor, consult your insurance provider or primary care physician and ask them to refer you to one. A supplemental vision coverage along with the Medicare plan can ensure coverage for the eye doctor’s visit.

Take Your First Steps Towards Maintaining And Protecting Good Vision As You Age

Schedule a consultation with experts at Medicare Mentors, NC’s top life insurance company, to learn about our extensive range of supplemental medical insurance or individual health insurance plans. Our agents can help you make guided decisions to ensure you enjoy maximum benefits with plans that suit their requirements.

At Medicare Mentors, we believe that a person’s golden years are like the exclamation point that indicates the end of the best time of their adventurous life. Medicare doesn’t include coverage for contact lens, eyeglasses, or routine eye exams in most cases.

Normally, it pays only when the intraocular lens is implanted following cataract surgery. Even then, Medicare Part B covers a pair of eyeglasses, corrective lenses, or one set of contact lenses that the ophthalmologist provides. Plus, this is only valid once in a lifetime and only on a standard pair of glasses, which means you’ll have to pay out-of-pocket for upgraded frames.

In addition, if you’re at high risk for glaucoma, have a family history of glaucoma, diabetes, or are an African American who is above 50 or a Hispanic American over the age of 65, a Plan B might also cover a screening once a year. It also covers certain treatments and diagnostic tests along with eye prostheses for patients with shrinkage or absence of an eye due to trauma, surgical removal, birth defect, or more.

As one of the top vision insurance service providers, we can pair your Medicare Advantage plan with suitable Medicare supplemental insurance to help you see the beauty of your golden years. However, if you’re looking for a plan covering contact lenses or upgraded eyeglasses and routine eye exams, call us to enroll yourself in a stand-alone plan. It combines dental, vision, and hearing insurance services on low premiums with more coverage than the Original Medicare plan.

You can also reach out to us to learn more about the affordable hospitalization insurance, hospital indemnity insurance, prescription drug plans, and other services that we offer as one of USA’s top life insurance service companies.